Adani Wilmar Share Price (AWL) has been one of the top companies attracting investor interest since going public in February 2022. The IPO price is Rs 230, and the shares are listed (May 2) at Rs 680, making a profit circa 2020. 80% off the list.

There are several reasons why most investors like this stock.

- One is that the outlook for the company looks good. However, he is considered the best player. Adani Wilmar plans to revamp his FMCG and food segments in the cooking oil market.

- 2 provides other kitchen essentials such as rice, wheat and flour, and cooking oil. Vegetables and sugar. These are staples, and such products are always in demand.

- And he said third; AWL is one of the companies with an integrated business model. In other words, manufacturing is well integrated so that one business segment supports another business segment. This promotes desired cost efficiencies for companies. Additionally, most of its raw material requirements are from the Wilmar Group (imported).

- Favour other factors such as AWL’s extensive distribution network and strong brand recognition capabilities

While it sounds like a good investment in stocks, there are some tips that investors should keep in mind and understand.

Table of Contents

About Adani Wilmar Share Price

The company was founded in 1999 as a joint venture between two major Indian conglomerates, the Adani Group and the Wilmar Group. Adani Wilmar is one of the most prominent players in his FMCG market, especially regarding kitchen essentials. These include edible oils, legumes, sugar, rice and flour.

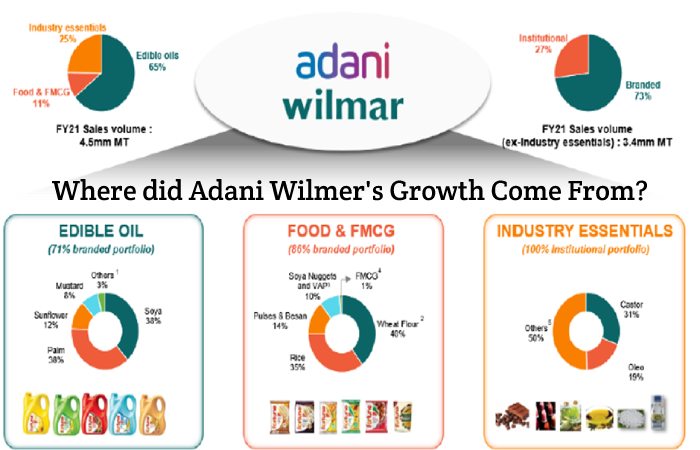

The company operates in three main categories. Edible oils account for about 83% of the company’s revenue. His two remaining segments—processed food, consumer goods, and industrial staples—account for 5% and 12% of the company’s revenue, respectively.

AWL also offers a wide variety of products in these three business segments. This diversification has helped reduce the risk of product dependency and has worked well for the company.

For example, consider the cooking oil business segment. AWL is active in all edible oil segments, with palm oil, soybean oil (38%), sunflower oil (12%), mustard oil (8%) and other oils accounting for approximately 38% of revenue and 3%. Exists.

Where did Adani Wilmer’s Growth Come From?

Adani Wilmar has strong brand credit in the domestic market and holds leading positions in most products.

Although the demand for products such as wheat, rice, flour, and edible oil is constant, some key factors will help the companies operating in these segments grow in the coming years.

Preference for Packaged Products:

Consumers are increasingly favouring packaged foods over unbranded products. According to industry reports, this segment could grow by 14% in the next few years. Health concerns and quality standards are accelerating this adoption.

For Adani Wilmar, the market situation bodes well. Regarding cooking oil, it has a dominant position in the market. It helps develop new value-added packaged foods.

- RTE (ready-to-eat) and RTD (ready-to-drink) products and firm kitchen staples, such as flour, rice, legumes, and Atta, have growth potential. The company also has plans to develop in this area.

- The FMCG field already competes with HUL and others, but there is still room for growth. This is because regional and local players fragment the market space for most kitchen essentials such as Atta and legumes. For example, AWL (through the Fortune brand) is entering its Atta market. In FY22, the company launched it’s Poha and Khichdi under his RTE.

Increased Consumption of Cooking Oil:

Oil, like water, is one of the essentials in his daily life. Keeping in mind the changing consumer tastes, new and innovative restaurants are entering the market, fuelling the growth of all cooking oils in India. Food processing facilities such as hotels are the largest consumers of oil. This is suitable for oil manufacturers like AWL.

Brand

The branded cooking oil market is highly competitive, but AWL’s Fortune brand is one of the greatest prominent players in the industry. Four essential edible oils bring in about 85% of the industry’s revenue with most players. These are palm oil, soybean oil, mustard oil, and sunflower oil.

- Palm oil is mainly used by hotels, restaurants and even catering companies. The rest of his 3 oils are for internal consumption. However, industry experts expect palm oil consumption to decline, given the health benefits of other oils. Therefore, there is also a demand for other oils.

AWL, like other players, has established oil brands to cater to consumers of all socioeconomic classes. For example, the Fortune sunflower oil brand is primarily for luxury consumers.

Distribution Network

Adani Wilmar has the largest distribution network of any industry player regarding cooking oils. The company has over 5,600 of his dealers in almost every state/UT. The company also sells its products through all e-commerce platforms and its online platform. It is valued that there are around 4.5 million retail outlets in India and Adani Wilmar asylums almost 35% of them.

Industry Essentials:

AWL, an industrial essentials business, offers oleochemicals, such as stearic acid, used to manufacture soaps and other household and personal care products.

We also supply castor oil and its derivatives to industries such as cosmetics and pharmaceuticals.

Finally, it provides de-oiled cake, a by-product of extraction such as soybean oil, castor oil, and mustard oil, and serves as feed for cattle.

He is one of the largest manufacturers of the industry’s most essential products. Raw materials are not difficult to procure, allowing the company to maintain and expand its market in this segment.

In addition, the company leverages oleochemical manufacturing in its FMCG division to provide soap and hand washing.

Key Strengths of Adani Wilmar Share Price

Now that you know Adani Wilmar’s Share Price growth potential let’s understand some of the company’s strengths.

Brand loyalty:

AWL is a market leader when it comes to Indian Edible Oils. ‘Fortune’ is the company’s flagship product and the best-selling edible oil in India, according to the company’s DRHP. The company’s other famous brands in various regions include King’s, Alpha, Raag and Jubilee.

AWL is considering a strategic acquisition, according to management. The plan is to strengthen market share through the addition of regional players. Adani Wilmar recently acquired the Kohinoor Rice brand to improve its position in the basmati rice business. Established presence in daily consumer goods

Adani Wilmar has raw solid material sourcing capabilities. His promotional organization, Wilmar International, is one of the world’s largest palm oil suppliers. It also gives the company an additional competitive advantage in sourcing raw materials. Therefore, the company does not rely on third-party providers. For example, in fiscal year 21, about 30% of imported raw materials by value came from his Wilmar group. This supply benefits his AWL from price volatility. Also, in India, the company has established an extensive procurement network.

Integrated Businesses:

Most of Adani Wilmar’s manufacturing units is fully combined with factories. For example, the company uses palm stearin from palm oil refining to produce oleochemicals (industrial) such as glycerine and stearic acid. It is also used in FMCG products such as soap and hand washing. This forward and backward integration enables the company to achieve cost efficiencies across its various business units. The company can also share its supply chain, storage facilities and distribution network.

Take Caution Before Stock Investment

Before considering buying or investing in Adani Wilmar as an investor, there are rare tips to keep in mind.

- Product prices often fluctuate between high and low seasons. As a result, AWL’s income may also fluctuate.

- Similarly, higher raw material prices can also lead to higher input costs. This can affect the company’s operating margin. Input costs accounted for about 85-88% of the company’s FY22 earnings.

- Considering AWL imports most of the raw materials it needs, currency fluctuations should also be considered before investing. In addition, government regulations such as interstate trade and geopolitical disputes (Russia-Ukraine situation) can pose risks to commodity prices. However, the company has risk mitigation strategies should such a situation arise.

- Competition in the businesses in which the company operates is fierce. For example, the company’s core edible oil business faces competition from Ruchi Soya, Kaleesuwari Refinery and Emami Agrotech.

- Considering that AWL is planning to expand into processed foods and other FMCG products, players such as ITC, Nestle, Pearl and Britannia are already in the space, thus increasing market share. Earning can be difficult.

Valuation:

Adani Wilmar’s IPO was priced relatively high (at the time of the IPO), but the share price increased from Rs 227 (list price) to Rs 680. Currently, the stock has traded about 110 times. This seems expensive compared to peers such as Ruchi Soya (41x) and HUL (58x).

Technical View on Adani Wilmar Share Price

Adani Wilmar Share Price made some pretty bullish moves shortly after going public. Her first three days yielded a massive return of about 70%. The stock formed an all-time high of 878 and went downhill from there.

The question here is whether this is a sound fix. Generally speaking, a 10-20% correction is healthy. But for Adani Wilmar, the action was corrected by over 25%.

Historically, stocks have been in an uptrend with lower highs and lower lows. But now the price is at a critical level with a support zone at Rs 640, which is also high. If the price breaks below this level, we can expect further selling.

FAQ

Q. How can I buy Adani Wilmar Ltd’s share?

A. Adani Wilmar Ltd shares can be purchased through a brokerage firm. ICICI direct is a registered broker through which you can place orders to buy Adani Wilmar Ltd shares.

Q. What is the share price of Adani Wilmar Ltd share?

A. The company’s stock price is volatile and will continue to change based on market conditions. As of Nov 16, 2022, at 11:11 am. m., Adani Wilmar Ltd closed at Rs 668.55.

Q. What is the market cap of Adani Wilmar Ltd?

A. Market capitalization or market capitalization is determined by multiplying the current market price of a company’s shares by the total number of shares outstanding. As of Nov 16, 2022, at 11:11 am. m., Adani Wilmar Ltd had a market cap of Rs.86,890.04.

Q. What is the PE ratio of Adani Wilmar Ltd?

A. Adani Wilmar Ltd’s Latest PE ratio as of 11:11 am on Nov 16 2022. m. is 126.28

Q. What is the PB ratio of Adani Wilmar Ltd?

A. Adani Wilmar Ltd’s Latest PB ratio as of 11:11 am on Nov 16 2022. m. is 0.09

Conclusion

In this blog, we have discussed adani wilmar share price. Therefore, Investing/Trading in Securities The market is subject to market risk and previous performance is no guarantee of future performance. The risk of loss in trading and investing in securities markets, including stocks and derivatives, can be substantial.